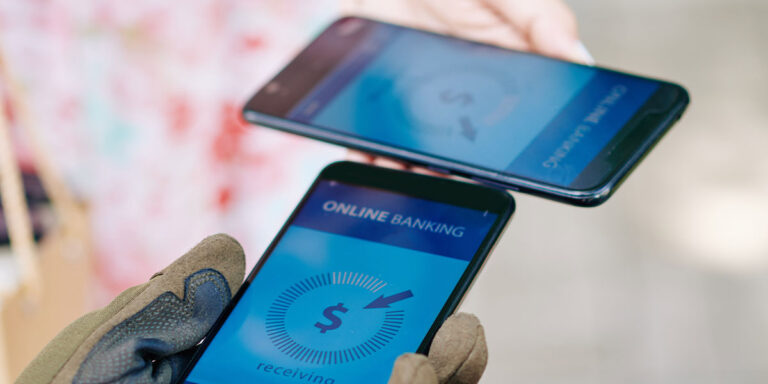

Our Open Banking Studio.

Shaping the future of Finance.

Enable Seamless Financial Connectivity and Innovation.

Open Banking is not just a revolution. It’s an empowerment for the financial industry. It creates opportunities for institutions to connect, innovate, and deliver highly personalized services. Our Open Banking Studio empowers financial organizations to securely integrate third-party applications, enhance customer experiences, and unlock new avenues of revenue. By leveraging cutting-edge APIs, secure data-sharing protocols, and advanced financial tools, we help your business stay competitive and forward-thinking in the rapidly evolving fintech landscape.

Our tailored open banking solutions are designed with a focus on compliance, security, and seamless integration. This ensures your organization meets regulatory standards while delivering a smooth, interconnected customer experience. Whether it’s enabling instant payments, personalized financial management tools, or seamless onboarding processes, we provide the technological foundation to drive growth and foster customer loyalty.

With Open Banking, financial institutions can harness the power of real-time data to offer more responsive, flexible services. This enhances customer satisfaction and opens up opportunities for collaboration with fintechs and other industry players. By partnering with us, you position your organization to thrive in this interconnected financial ecosystem, driving innovation and profitability.

From unlocking new revenue streams to providing tailored services that meet the evolving needs of today’s consumers, our Open Banking Studio is your gateway to future-proofing your business in a dynamic and fast-moving digital world. With a strong emphasis on security and compliance, we ensure that your data-sharing practices are safe and aligned with the latest industry regulations. Our solutions enable financial institutions to stay ahead of regulatory changes while maintaining customer trust and confidence.

With deep expertise in Open Banking, we specialize in delivering tailored solutions that empower financial institutions to innovate, enhance customer experiences, and unlock new revenue opportunities.

Boost Customer Loyalty through Personalized Financial Products

Retail banks can enhance their customer relationships by offering tailored financial products based on data insights shared securely through open banking. Whether it’s personalized loans or tailored investment opportunities, open banking enhances the banking experience.

Payment Providers

Frictionless Payments with API Connectivity

Payment providers can streamline transactions and reduce costs through direct API integration with banks. Our platform ensures secure and instant transactions, providing customers with a smooth, transparent payment experience.

Collaborate and Innovate with the Fintech Ecosystem

Open Banking enables seamless collaboration between banks and fintechs, fostering innovation and expanding service offerings. Whether you’re building new financial tools or improving customer experiences, our solutions help you unlock the potential of fintech partnerships.

Built on Security, Driven by Trust.

Advanced Security Protocols and Regulatory Compliance.

At the core of open banking is secure data sharing and customer trust. Our Open Banking Studio offers industry-leading security measures, ensuring that your customers’ data is protected at all times. We adhere to global standards like PSD2, GDPR, and other financial regulations, helping you maintain compliance and build trust with your customers.

Built for Flexibility and Scalability.

Customizable APIs and Scalable Infrastructure.

We design and develop your platform to be flexible, allowing you to integrate the open banking tools that suit your business needs. With a focus on scalability, our solution grows alongside your business, ensuring that you can handle increasing API demands and data flows seamlessly. Our modular approach enables you to add functionalities as needed, while maintaining performance and security.

Unlock the Power of Open Banking.

Open Banking is a groundbreaking development in the financial sector that gives customers more control over their financial data and the ability to access a wider range of personalized services through digital platforms.

It enables customers to securely share their banking information with trusted third parties, such as fintech companies, tech firms, and other financial institutions, breaking down traditional silos that have long separated banks from external service providers.

Through Application Programming Interfaces (APIs), Open Banking allows financial data to flow securely between institutions, empowering customers to make better financial decisions and access services tailored to their specific needs. This includes everything from budgeting tools and personalized loan offers to innovative payment solutions and investment products. With Open Banking, customers can link their bank accounts to third-party apps, gaining insights into their spending habits, credit scores, and financial health, all while ensuring their data is handled with the highest levels of security and privacy.

The driving principle behind Open Banking is that customers should own and control their financial data. This shift is transforming the industry by creating an ecosystem where collaboration between banks and third parties can lead to more innovation, better products, and improved financial outcomes for customers. For example, a customer might use a fintech app to compare and switch between different financial products, such as loans or savings accounts, based on real-time data shared via Open Banking protocols.

Additionally, Open Banking helps financial institutions stay competitive by allowing them to integrate with cutting-edge technologies and offer more diverse services without building them in-house. This enhances the customer experience and opens new revenue streams for traditional banks, which can partner with fintechs and other third-party providers to offer joint solutions.

ISO 20022 and Open Banking work together to enhance financial transactions with standardized messaging and secure data sharing. ISO 20022 provides rich, structured data for consistency, while Open Banking enables seamless API-driven access. Together, they improve payment processing, fraud detection, and personalized services, creating a more efficient and connected financial ecosystem.

As Open Banking continues to evolve, it’s set to reshape the financial landscape by fostering greater transparency, competition, and customer empowerment. It creates opportunities for financial institutions to build stronger customer relationships, improve product offerings, and adapt quickly to changing market demands. The result is a more connected, efficient, and customer-focused financial ecosystem where consumers have the tools to make informed decisions and take control of their financial future.

Use Cases of Open Banking.

Seamless API Integration

Our Open Banking solutions enable fast, secure, and reliable API integration, allowing financial institutions to seamlessly connect with third-party providers. Whether you’re looking to expand your services or enhance your current offerings, we ensure the highest standards of security and compliance.

Personalized Services Tailored to Customer Needs

Open Banking enables financial institutions to deliver more personalized and relevant customer experiences by securely sharing data across platforms. Our solutions allow you to create tailored financial products that meet customer demands, increasing satisfaction and retention.

Compliance and Data Security at the Core

Our Open Banking solutions are designed to meet all regulatory requirements, ensuring data security and privacy. From PSD2 to GDPR, we help you stay compliant while providing innovative services that drive business growth.

Expand Opportunities through Open Innovation

Open Banking unlocks new business models and revenue streams. By leveraging API ecosystems, your organization can offer value-added services, collaborate with fintechs, and innovate faster than ever before. Our platform helps you maximize these opportunities and gain a competitive edge.

Success Cases.

Success Cases.

Helping businesses of all sizes across the Americas flourish.

Helping businesses of all sizes across the Americas flourish.

Transform Your Business with Open Banking.

Contact Us to Learn How Open Banking Can Drive Innovation and Growth in Your Business.